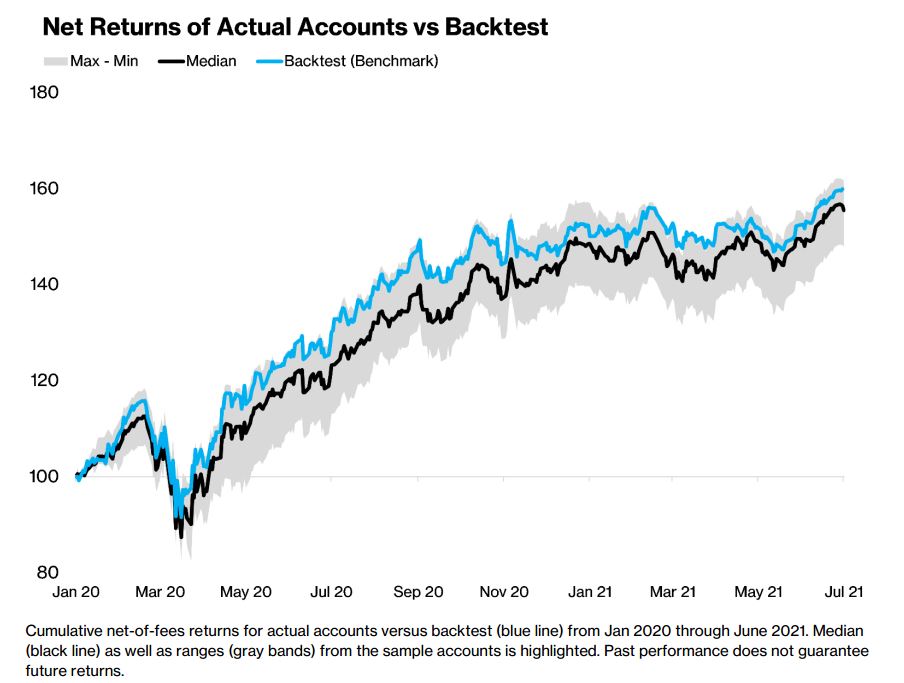

As we have noted in the past, we simulate everything we do in a backtesting framework. Recently, we asked ourselves: (1) how does our backtest compare to reality, and (2) how closely do our clients who might be cost-constrained due to smaller balances track this measure.

Key takeaway: Our analysis from a sample of actual live accounts confirms that client accounts closely track the simulation results from our backtesting framework. This is great news! Even more important, the accounts closely tightly track each other, despite the over 25x difference in average balance between the largest and smallest! Lastly, the introduction of fractional trading by our primary brokerage partner halved the tracking error between accounts leading to even higher operational efficiency.

A key tenet of our approach is to take a systematic approach to portfolio management. At the start of our journey, the engineers on the founding team took months to build a custom backtesting framework — i.e. a simulator — that allows us to test various ideas before deploying them in the real world. The multi-year work laid the foundation for how we operate.

Till today, all our [best] ideas are rigorously simulated before being introduced to client accounts. But in this industry, most backtest results usually look super good-looking — only to fall short in reality.

Despite many factors, results from our analysis confirm that our backtest (blue) doesn't just tightly track actual accounts; it falls within tight bands (not above the gray lines). Simply put, our backtest simulator isn't blowing smoke!

Earlier this year, our primary brokerage partner introduced fractional trading — which allows us to invest as little as $1 in most stocks on behalf of clients, irrespective of its trading price. This further allowed us to put more of your money to work even for accounts with cost constraints. Our findings in early January (see page 7+) suggested that this might be a big win for accounts of all sizes. Today, we confirm that incorporating fractional trading also halved the tracking errors for both small and large: client portfolios with smaller balances are not left out of gains due to cost constraints of us adding nominally expensive stocks to our investable universe.

Both findings reaffirm a high operational efficiency as (1) actual accounts mimic our simulator (2) our separately managed accounts track each other closely even after accounting for factors like differences in account size, execution times, the timing of cash flows, etc. Read the white paper here.