There has been a lot of talk about inflation as the economic recovery continues.

Key takeaway: Our macro outlook remains positive despite the downside risk posed by the pandemic and its influence on consumer behavior and Fed policies. In all, we view inflationary risks as transitory.

Inflation is the increase in the prices of goods & services over a period of time. It can affect investment returns so it behooves us to understand how it affects our portfolio and to form a view of its outlook.

Decomposing impact on investment returns

As the prices of goods & services rise, purchasing power falls as you will be able to purchase fewer goods & services (unless your returns are indexed to inflation). This is why it’s the real return—nominal return minus (expected) inflation—that should concern us when we compare the attractiveness of different assets and asset classes. All equal, the higher we expect inflation to be in the future, the lower the real return.

How high is expected inflation?

Two popular metrics that proxy for expected inflation are the 10-year breakeven inflation rate (which captures implied inflation expectations by investors a decade from today) and the 5- year/5-year forward inflation expectation rate (expectations 5 years from today). The chart indicates that expected inflation is currently roughly equal to its pre-pandemic average of 2.3 percent. This implies—at least for now, the pull forward anticipated inflation is as expected.

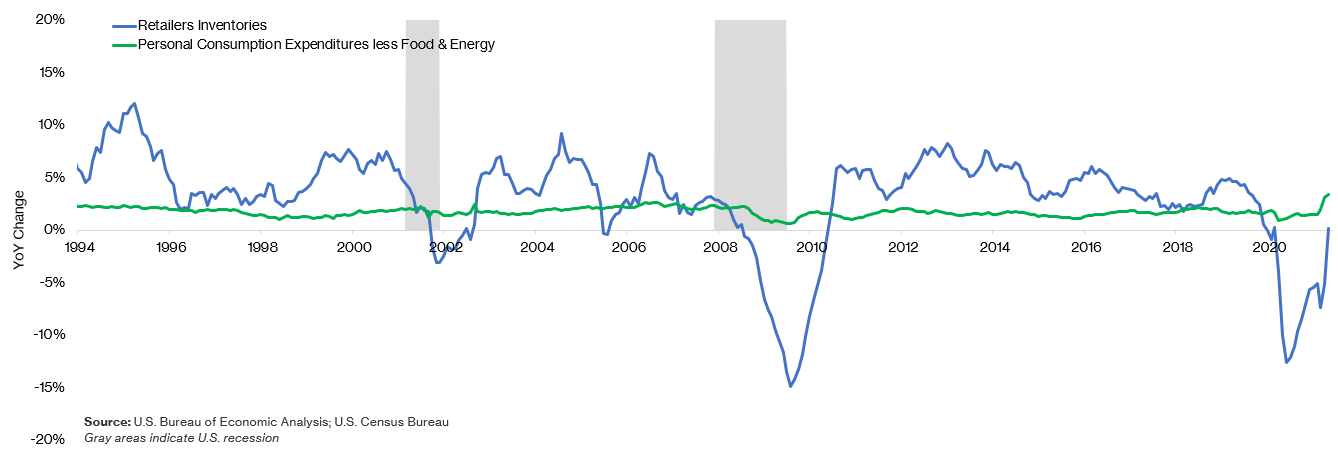

The Consumer Price Index is a common measure of inflation by economists. By that measure, prices recently grew 5.4 percent in July relative to a year ago. But this measure might be a bit deceiving. Much of the world was in lockdown last year and global supply chains were disrupted. Households drastically cut their consumption, and retailers lowered inventories to meet the lesser demand. Most businesses faced with less demand, were hardly in a position to increase prices. The Fed also drove interest rates to near-zero and injected a lot of money into the system. Additionally, there was substantial fiscal support from the US Congress. Now that economies have opened up, we are faced with surging post-pandemic demand, supported by monetary and fiscal policy, against global supply chains that have not fully recovered (see chart below). Again, all things considered, inflation is where we expect.

Our outlook

For us, there are two risk factors we are monitoring: (1) Fed guidance on rate hikes and (2) consumer behaviors.

One possible risk is that the Fed raises rates earlier than expected. This would increase the rate at which investors discount future cash flows from their investments. Rising rates would lower the value of the financial assets impacting real returns. Another concern is that inflation expectations become unanchored and high inflation becomes self-fulfilling: If everyone anticipates dramatic price increases, they may act in ways that cause prices to increase dramatically i.e. rush to buy things before they get more expensive, which in turn further pushes prices up. The resultant increase then justifies their concerns, pushing them to pull inflation higher by repeating the cycle and so on. This latter risk is somewhat accentuated by the fact that the Fed recently changed its monetary policy strategy to target average inflation—thus tolerating higher inflation for longer periods—in order to improve the efficacy of its tools. Nevertheless, we view these risks as transitory and partially offset by the downside risks of a prolonged pandemic. We continue to monitor macroeconomic developments and stand ready to respond as necessary.