The investing community has been talking about the "coming" green transition for years. However, as is the case with all mega-trends (the internet, streaming, e-commerce), even if you feel like you are late to the party there is still plenty of upside left if you can successfully identify the right players. If you had bought into FAANG stocks in the last decade, you would have solid returns despite these already being established household names.

Maturing green technologies and rapidly falling costs continue to drive investment flows to renewable energy globally. According to BloombergNEF, an estimated $282 billion was invested in renewable capacity in 2019, with solar and wind accounting for 46% and 49% of the investments, respectively.

The regulatory push by policymakers to lower greenhouse-gas emissions along with the significant drops in costs of solar and wind—falling 85% and 49% respectively from a decade ago—has also accelerated the decommissioning of coal and gas plants as the world gets greener. Even China, the world’s largest polluter (and soon-to-be world’s largest economy), has enacted policies to expand its renewable energy capacity. China is on track to overtake the EU as the world leader in installed capacity by the end of this year.

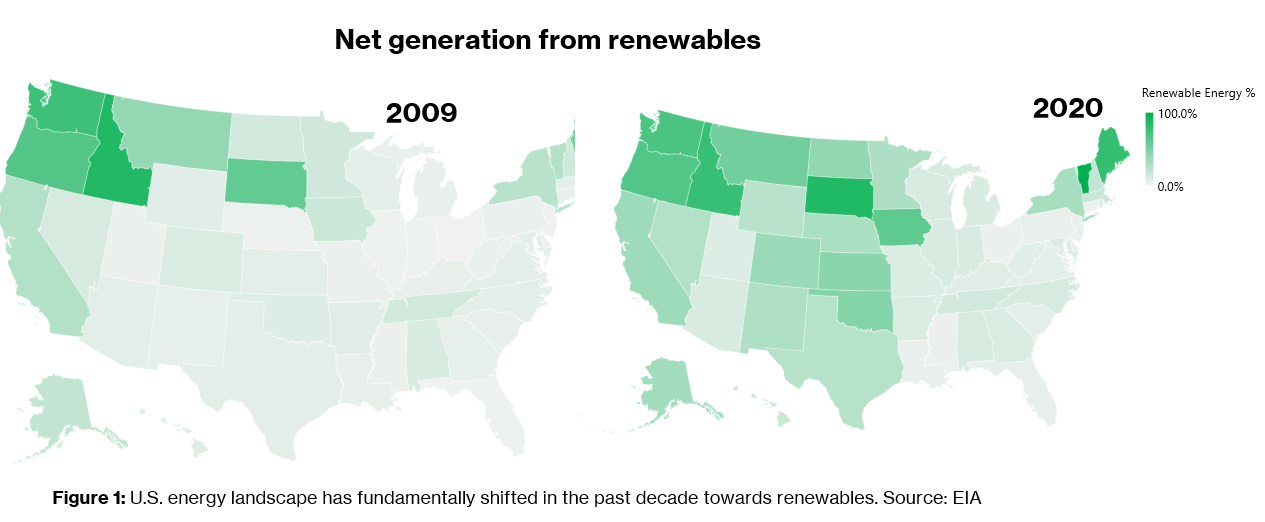

Here in the United States, the energy landscape has also fundamentally shifted in recent times. According to The U.S. Energy Information Administration (EIA), renewables accounted for 21% of electricity generation last year, up from 11% about a decade ago. EIA projects that by 2050, over 40% of electricity will be from renewables—primarily solar and wind. And this national trend is spread across several states. A closer look at each state’s net renewable generation capacity shows a slow green transition, partly driven by policy.

Today, many states—38 to be exact—have established renewable portfolio standards or goals that focus on greener energy sources. States like Virginia, Alaska, the District of Columbia, Connecticut, Minnesota have set very aggressive targets over the next few decades.

It is also worthy to note secondary effects of transition as highlighted in a recent interview by Rhett Bennett of Black Mountain Metals. The rapid push for electric vehicle adoption and the associated energy transition will strain natural resource supply lines. Copper supply is expected to fall short of demand by 1 million tonnes annually. At our current, we would need to discover and develop a mine the size of the Escondida mine in Chile (the largest in the world) every 24 months from now until 2030! A tall order.

We believe investors should heed Wayne Gretzky’s advice and “skate to where the puck is going to be, not to where it has been”. Recently, we sought to translate this macro trend into actionable investment insights, looking closely at the key players in this space, especially in solar. Most firms so far fail our "sniff" test i.e. a fundamentally strong business that offers a relative safety of capital and favorable risk-to-reward ratio in the long run! All that glitters is not gold, but we will keep searching.