The unprecedented policy support from governments and central banks around the world helped quickly push advanced economies like the US out of the pandemic-induced recession. Indeed, the National Bureau of Economic Research (NBER) marked February through April of 2020 as a recessionary period, making this the shortest US recession in recorded history! With the arrival and steady distribution of the vaccines—variants and other hiccups notwithstanding—it seems we are closer to the end than the beginning of the pandemic. Throw in a tight labor market and the fact that most households built up excess savings over the past year, and you have the makings of a protracted economic upswing. All this supports our ‘risk-on’ position. Against this backdrop, we thought it would be useful to provide a review of how our macro risk framework responded to last year's developments in real-time and what this meant for our risk positioning.

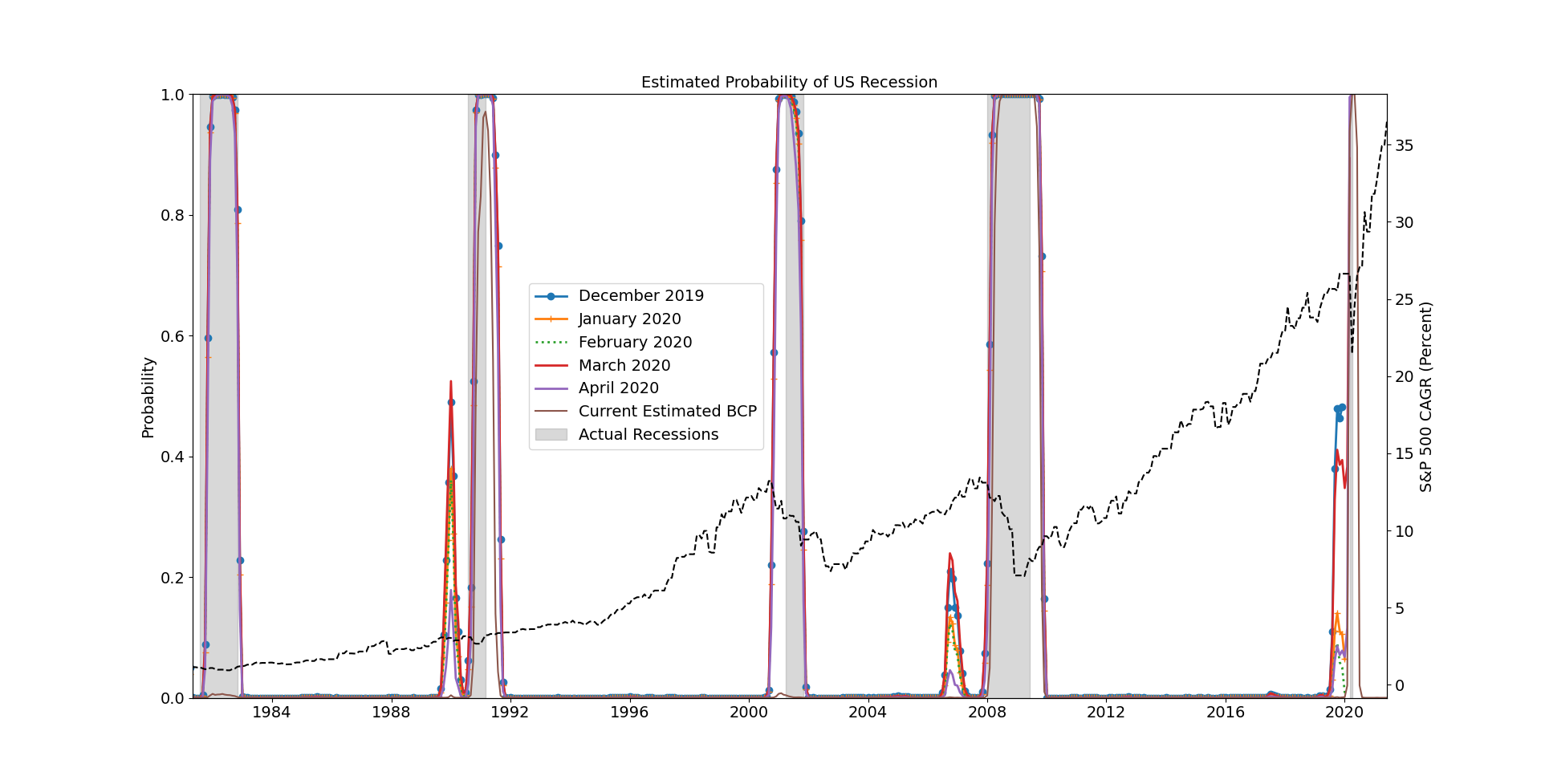

Let’s start with the basics. Given an asset portfolio and parameters that govern the aggressiveness of our risk stance, our proprietary framework decides how much money to allocate to each asset in the portfolio, subject to trading controls. Each piece of this puzzle has been painstakingly constructed and calibrated to optimize the algorithm’s performance and is frequently reviewed for operational excellence. As described in previous correspondence, our ‘business cycle predictor’ (BCP) adjusts the parameters that govern the risk stance by responding to changes in macroeconomic variables and financial indicators. If the dashboard starts flashing red, the algorithm automatically adjusts these parameters to a more cautious posture. The chart below shows the evolution of our estimates over time compared to the NBER (retroactive) dating.

It shows that developments in December 2019 pointed already to a slowing economy though this was unrelated to the pandemic. Macro data from the months of January and February 2020 indicated that this would have been a false flag ... but then the pandemic hit, and the BCP dashboard started flashing again. Cycling forward through this period shows that the model accounts well for the pandemic but of course this is with the benefit of hindsight.

Naturally, understanding where we stand in the business cycle is very crucial to any investor. However, NBER announcements are typically very delayed—months or years after the event—diminishing its real-time utility for investors. For example, the announcement for the start of the 2020 recession came after a 4-month delay while the end of the recession was recently announced 15 months after! Having the ability to quickly quantify and adjust to transitions in business cycles can be advantageous.

To complement our just-in-time model, we also utilize a look-ahead model that predicts the probability of a recession occurring over the next twelve months. But, frankly, no forecasting model that depended on traditional macro data—which often arrive with a lag—could have caught an out-of-sample event like COVID-19. Nevertheless, this quantitative approach helps us reduce sentiment in our risk management. As difficult as it was, we stuck to our disciplined approach with a long-term outlook, and the Xantos Labs community benefited from this.